Medical Injection Molding Market Size, Growth, and Trends Report 2025-2033

Market Overview:

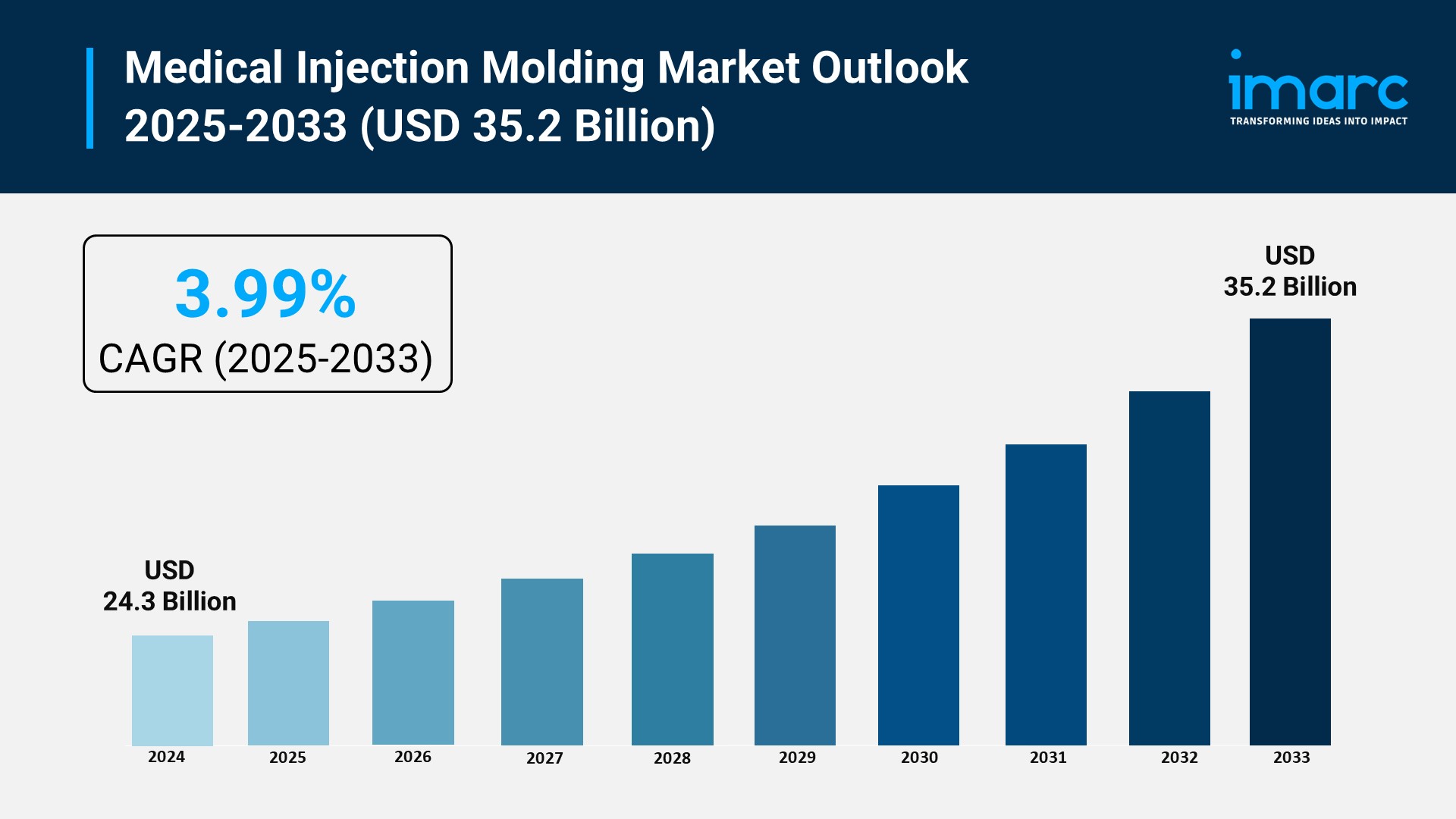

The medical injection molding market is experiencing rapid growth, driven by increasing global chronic disease burden, technological advancements and miniaturization, and supportive government initiatives and investments. According to IMARC Group’s latest research publication, “Medical Injection Molding Market Report by System (Hot Runner, Cold Runner), Class (Class I, Class II, Class III), Material (Plastic, Metal), and Region 2025-2033”, The global medical injection molding market size reached USD 24.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 35.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.99% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/medical-injection-molding-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Medical Injection Molding Market

- Increasing Global Chronic Disease Burden

The rising prevalence of chronic conditions worldwide is a primary driver for the medical injection molding industry. Conditions such as diabetes, cardiovascular diseases, and respiratory illnesses necessitate a continuous, high-volume supply of medical devices for diagnosis, treatment, and ongoing management. For instance, the US Centers for Disease Control and Prevention (CDC) indicates that approximately 60% of American adults suffer from at least one chronic disease, which translates to a constant demand for diagnostic tools, drug delivery systems like insulin pen components and syringes, and monitoring devices. This persistent and large-scale need directly fuels the requirement for injection molding to produce cost-effective, high-quality plastic components and consumables at immense scale. The reliability and precision of this manufacturing method are crucial for maintaining patient safety and treatment efficacy.

- Technological Advancements and Miniaturization

Continuous innovation in medical technology, especially the trend toward minimally invasive procedures and portable devices, is a major growth factor. Modern surgical techniques require smaller, more intricate instruments, and portable monitoring equipment demands compact, lightweight components. The medical injection molding market addresses this through techniques like micro-molding, which is capable of producing parts with exceptionally tight tolerances and features at the micro- and nano-level. This precision capability is vital for components in complex devices such as endoscopes, catheters, and microfluidic diagnostic chips. For example, the segment of the plastic injection molding machine market focused on the 0-200-ton clamping force, which is typically suited for smaller, precision parts, accounted for over 59% of the market share in 2024, highlighting the accelerating focus on smaller-scale, high-precision manufacturing in the MedTech space.

- Supportive Government Initiatives and Investments

Government policies aimed at fostering domestic medical device manufacturing significantly accelerate market expansion, particularly in emerging economies. The Production Linked Incentive (PLI) Scheme for Medical Devices in India, for example, offers financial incentives of 5% on incremental sales of domestically manufactured devices over a base year. This significant policy support encourages both multinational corporations and local companies to establish or expand high-volume, precision manufacturing capabilities for devices like radiology equipment, implants, and diagnostics, all of which heavily rely on injection molded components. Additionally, programs supporting the creation of Medical Device Parks, which provide shared infrastructure and testing facilities, reduce the initial capital outlay for manufacturers, thereby boosting the overall production capacity of the region.

Key Trends in the Medical Injection Molding Market

- Adoption of Industry 4.0 and Automation

The integration of Industry 4.0 concepts, including sophisticated automation, robotics, and real-time data analytics, is a major emerging trend. This move goes beyond simple automation to create “smart” manufacturing floors. For example, a company like C&J Industries, a major manufacturer, expanded its medical-grade capacity by adding a new Class 8 cleanroom featuring all-electric Toshiba molding presses integrated with automated 3-axis robots for efficient production and inspection. This level of automation not only increases production speeds and volumes—critical for disposable items—but also provides a continuous stream of data for quality assurance and traceability, which are essential for meeting stringent regulatory standards like ISO 13485, minimizing human error and ensuring that every batch of parts is reliably uniform.

- Shift Toward Sustainable and Biocompatible Polymers

Driven by environmental awareness and increasingly strict regulatory requirements, there is a distinct trend toward using sustainable, non-petroleum-based materials and next-generation biocompatible polymers. This includes the exploration and adoption of bioplastics in non-implantable medical consumables and a focus on highly durable, sterilizable, and high-performance engineering plastics like PEEK and certain polycarbonates for critical devices. These advanced materials must ensure tolerance with the human body and withstand demanding sterilization methods, such as autoclaving, without degrading. This trend is visible in market segmentation data, where the overall Thermoplastics segment currently holds an overwhelming share, demonstrating the material flexibility necessary for this high-specification evolution in component design.

- Advanced Multi-Shot and Multi-Component Molding

A significant trend is the increasing use of advanced molding techniques, such as multi-material (multi-shot) molding and insert molding. These processes enable the creation of complex, multi-functional medical devices in a single, highly efficient cycle, rather than through subsequent assembly steps. For example, overmolding is used to produce surgical handles and grips by molding a soft, tactile elastomer material directly onto a rigid plastic substrate, improving ergonomics and user safety. The growing demand for more complex geometries and the need to integrate multiple functions (like seals and ports) into a single piece drive the adoption of sophisticated hot runner systems, which held over 55% of the global market earnings in 2023. These systems facilitate quicker cycle times and reduced material waste, demonstrating the economic efficiency of complex single-process manufacturing.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=3653&flag=E

Leading Companies Operating in the Medical Injection Molding Industry:

- AMS Micromedical LLC

- Arburg GmbH + Co KG

- Bright Plastics

- C&J Industries

- Currier Plastics Inc.

- ENGEL Austria GmbH

- Harbec

- HTI Plastics (Pce Inc.)

- Molded Rubber & Plastic Corporation

- Metro Mold & Design

- Milacron (Hillenbrand Inc.)

- Proto Labs Inc.

Medical Injection Molding Market Report Segmentation:

By System:

- Hot Runner

- Cold Runner

Hot Runner dominates the market due to its efficient production and minimal waste, essential for high-quality medical device manufacturing.

By Class:

- Class I

- Class II

- Class III

Class I leads the market as low-risk devices like bandages benefit from high production volumes and cost-effectiveness in medical injection molding.

By Material:

- Plastic

- Metal

Plastic dominates the market because of its versatility, biocompatibility, and cost-effectiveness, making it ideal for a wide range of medical applications.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific leads the market, driven by rapid industrial growth, increasing healthcare demands, and significant investments in medical technology.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302