Heavy Construction Equipment Market Size, Share & Growth Analysis 2025-2033

Market Overview:

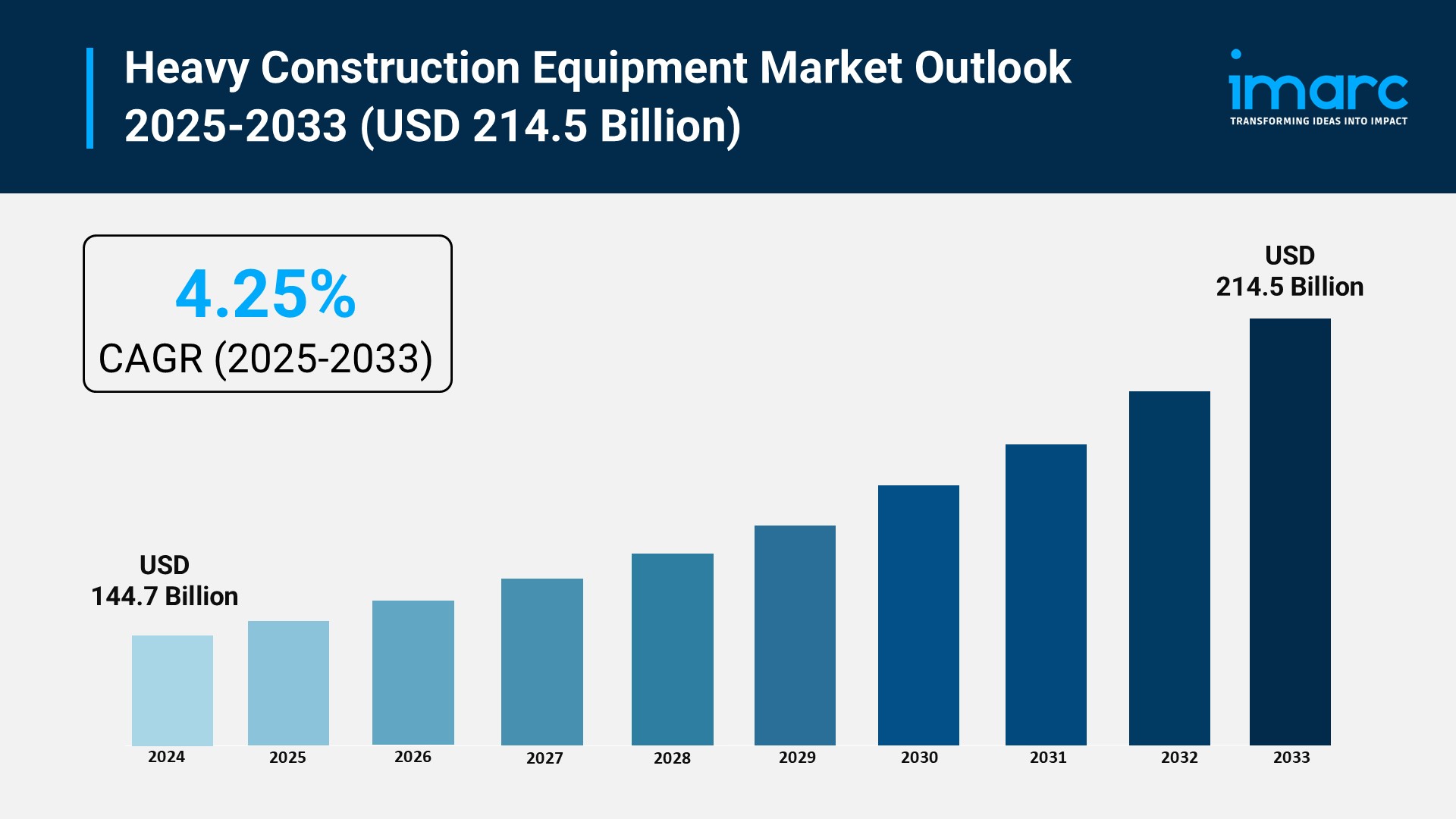

The heavy construction equipment market is experiencing rapid growth, driven by surging global infrastructure investment, accelerating urbanization in emerging economies, and technological integration and automation. According to IMARC Group’s latest research publication, “Heavy Construction Equipment Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, the global heavy construction equipment market size reached USD 144.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 214.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.25% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/heavy-construction-equipment-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Heavy Construction Equipment Market

- Surging Global Infrastructure Investment

The primary driver is the massive global investment in infrastructure development, particularly large-scale public projects aimed at modernization and connectivity. Governments worldwide are allocating substantial funding for new roads, bridges, railways, and utilities to support economic expansion and accommodate population growth. For instance, the Bipartisan Infrastructure Law in the US commits approximately $1.2 trillion in funding for various projects, while the EU infrastructure development fund has allocated approximately €828.8 billion. Similarly, the Asia-Pacific construction industry, valued at approximately $4.36 trillion, represents about 45% of the global industry, with continued focus on developing new rail networks and roadways in countries like China and India. This sustained, multi-trillion-dollar expenditure provides a predictable and robust demand base for a full range of heavy equipment, from excavators to road-building machinery.

- Accelerating Urbanization in Emerging Economies

Rapid urbanization, especially across emerging economies in Asia-Pacific and Africa, is creating an unprecedented demand for residential, commercial, and supporting civic infrastructure. As more of the global population migrates to urban centers, the necessity for new high-rise buildings, integrated transport systems, and utility networks drives the need for sophisticated machinery. The construction industry in Asia-Pacific is a key beneficiary, where countries are experiencing significant growth in their urban populations, placing stress on existing infrastructure and fueling new development. This requires high-efficiency heavy lifting equipment like cranes and material handling gear. The drive for “smart city” initiatives further accelerates this growth, as projects demand advanced, high-precision equipment to meet modern urban planning standards and timelines.

- Technological Integration and Automation

The adoption of advanced technologies like telematics, automation, and IoT (Internet of Things) is revolutionizing the heavy construction equipment market, enhancing productivity and reducing operating costs. Manufacturers are integrating digital solutions into their equipment to offer features such as real-time performance monitoring, predictive maintenance, and remote diagnostics, significantly minimizing equipment downtime. For example, the earthmoving equipment segment—which accounted for about 59.45% of the construction equipment market share—is increasingly integrating GPS and sophisticated sensor technology for precise grading and site management. This shift is also influenced by increasing labor shortages, making semi-autonomous and autonomous machinery attractive for improving job site safety and operational efficiency across complex projects.

Key Trends in the Heavy Construction Equipment Market

- Electrification of Construction Fleets

A major trend is the accelerating transition towards electric and hybrid heavy construction equipment, driven by stricter global emission regulations and a corporate focus on sustainability. While internal combustion engines currently hold a significant market share, the demand for battery-electric units is rising quickly, supported by technological improvements in battery performance and decreasing costs. Equipment manufacturers like Volvo CE and JCB are actively developing and launching new electric models, such as mini-excavators and compact wheel loaders, particularly for use in urban and noise-sensitive environments. This shift is also supported by government incentives and is essential for construction firms operating near residential areas or in regions with zero-emission zone mandates.

- Deepening Integration of Telematics and IoT

The widespread integration of telematics and IoT sensors is transforming heavy equipment into connected assets, optimizing fleet management and site operations. This technology allows for the continuous collection of performance data, including fuel consumption, idle time, and machine health. This information is processed by sophisticated algorithms to enable predictive maintenance, which significantly cuts down on unexpected failures and lowers long-term operational costs. For instance, real-time data from a fleet of dozers or haulers can be used to optimize routes and scheduling, improving job-site efficiency. The use of IoT-enabled equipment is moving from a high-end feature to a standard offering, crucial for modern, data-driven construction management.

- Circular Economy Practices and Remanufacturing

The adoption of circular economy principles is an emerging trend focused on sustainability and resource efficiency. This involves designing equipment for greater recyclability and promoting robust remanufacturing and component reuse programs. Key players are establishing dedicated facilities to refurbish major components like engines, transmissions, and hydraulic systems to like-new condition. This extends the service life of expensive machinery components, reducing the overall carbon footprint of the construction process and offering contractors a more cost-effective alternative to new purchases. This practice directly addresses environmental concerns and positions manufacturers as leaders in sustainable business practices.

Leading Companies Operating in the Global Heavy Construction Equipment Industry:

- AB Volvo

- Caterpillar Inc.

- CNH Industrial N.V.

- Deere & Company

- Hitachi Construction Machinery Co. Ltd. (Hitachi Ltd.)

- Hyundai Doosan Infracore Co. Ltd.

- JCB Ltd.

- Komatsu Ltd.

- Liebherr AG

- SANY Group Co. Ltd.

- Terex Corporation

- XCMG Group

Heavy Construction Equipment Market Report Segmentation:

By Equipment Type:

- Earthmoving Equipment

- Material Handling Equipment

- Heavy Construction Vehicles

- Others

Earthmoving equipment represents the largest segment because it is essential for a wide range of construction tasks, including excavation, grading, and site preparation.

By End User:

- Infrastructure

- Construction

- Mining

- Oil and Gas

- Manufacturing

- Others

On the basis of the end user, the market has been segregated into infrastructure, construction, mining, oil and gas, manufacturing, and others.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position in the heavy construction equipment market due to rapid urbanization, infrastructure development, and increasing industrial activities.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302